IRS

Annual Federal Tax Refresher Course (AFTR)

The

packages offered for the AFTR satisfy requirement for the new Annual Filing

Season Program (AFSP).

Our

classes are offered live ONLY

IRS

CE Program chart

Each

package include 18 hours of continuing education for Filing Season 2023:

-

six (6) hour Annual Federal Tax Refresher (AFTR) course

- 10 hours of other federal tax law topics and

- two (2) hours of ethics.

Comprehensive

Review classes

Review

classes are offered that fit various levels of tax knowledge

Our

classes are offered live, internet or live streaming

Enrolled Agent Exam Part I , II , III

Intensive

and extensive preparation for preparers wanting to sit the SEE exam .

Our EA books covers the three (3) part exam with detailed problems and

solutions .

Tax Preparers in this income tax class have successfully passed

the exam the first time at our prep class.

Mastering

1040 for beginners 10 credits (TBD)

Learning tax preparation- includes the new Annual Federal Tax Refresher

Course .

Fling

season record of completion directly from the IRS.

It starts at the basic and progresses ; for learning or improving tax

preparation skills .

Mastering

1040 Advanced

This

class involves comprehensive study leading to mastering 1040 tax return

preparation at advanced level

For individuals in the tax profession needing advanced knowledge including

the full scope of returns. Includes capital gains and losses , more complex

installment sales and estate and trusts.

Enrolled

Agents Continuing Education

ATP

Business Solutions Inc., offers EA continuing education packages that

satisfy

requirements for 72 hour cycle CPE .

Each

CPE package include:

-

three (3) hours of federal tax law updates,

- 10 hours of other federal tax law topics ( of choice)

- two (2) hours of ethics.

Federal

tax law topics can be combined to achieve the minimum yearly requirement.

Exempt Preparers

Yearly 15 hour continuing education

Our

classes are offered live, internet or live streaming

Return preparers who can obtain the AFTR –

Record of Completion without taking the AFTR course are:

•Anyone who passed the Registered Tax Return Preparer test administered

by the IRS between November 2011 and January 2013 , and satisfy their

original 15 hour continuing education requirement each year.

Persons who passed certain other recognized national and state tests are

exempt from the six hour federal tax law refresher course with test. (

active registrants of the Oregon Board of Tax Practitioners, California

Tax Education Council, and/or Maryland State Board of Individual Tax Preparers

.SEE

(Enrolled Agent) Part 1 Test-Passers (within past two years),

•VITA

volunteers: Quality reviewers and instructors with active PTINs,other

Accreditation Council for Accountancy ABA and ATP program holders.)

Each

CPE package include:

-

three (3) hours of federal tax law updates,

- 10 hours of other federal tax law topics ( of choice)

- two (2) hours of ethics.

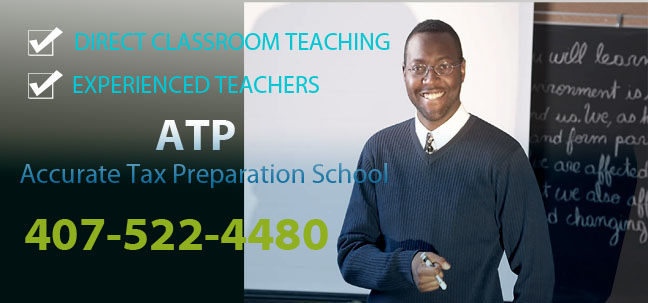

ATP

Business Solutions Inc offers direct classroom , self study tax classes

for tax preparers fulfilling IRS continuing education. Our income

tax school is open year round for tax classes including Enrolled

Agent Continuing Education classes and IRS Special Enrollment Exam

(SEE) Review Class. . Our IRS tax classes in Orlando Florida

"is dynamic" that's what tax preparers who attend our classes

say.

New

Annual Federal Tax Refresher Course

-

Set

up your company information

-

Set

up chart of accounts

-

Vendor:

bills, bill payments, checks, bill payment stubs, credit memos and

more

-

Customers:

invoices, receipts, payments, deposits, customer statements

-

Sales

Tax, set up, adjust, pay and report

-

Inventory:

purchase order, receive items, adjust inventory, closing inventory

-

Cash

Register, petty cash , bank reconcilation

How to start an income tax office

1. Location , location , location is key to success.

2. Register for EFIN for your office to efile taxes-

do this well in advance with the IRS (normally takes 2-3 months) fingerprinting

and background checks are done. Enroll at irs.gov , tax pro to create

an account.

3. Register with IRS for a PTIN , and pass competency

exam (RTRP) (exam on hold)

4. Attend a yearly 15 or 18 CE IRS course (voluntary)

5. Train Staff

6. Purchase professional software eg drake,taxwise,proseries,

refunds today

7. Provide documents (privacy policy , intake sheets

to customers)

Learn this and more at our income tax school

At

ATP Business School we offer classes in Tax Preparation including Enrolled

Agent Review Course , and our CPE (continuing education courses). Attending

ATP Business Solutions Inc newAnnual

Federal Tax Refresher Course

class automatically earns you CPE credits for the yearly 18 hour Continuing

Education . Enrolled Agents can choose topics to satisfy the 72 hours

CE requirement from any of our CE classes . Our IRS approved tax classes

at our income tax school also offer CE credits for enrolled retirement

plan agents . Tax Preparers can attract more business as the public is

assured of such person's competency in taxation.We also offer classes

in Microsoft Office Programs, Accounting Software such as Quick Books

, Tax Programs - Taxwise Software and other classes in Marketing, Business

Ethics, Office Policy and Procedures and Payroll Training . Read

More

Tax Preparer Updates

Enrolled Agent (EA)

Who is an Enrolled Agent ?

Individuals who have passed a three (3-) part comprehensive

IRS exam on individuals, businesses and representaion , like CPAs and

Attorney have unlimited practice rights before the IRS in representing

clients. Some individuals through experience as a former IRS employee

can receive this designation. Enrolled agent status is the highest credential

the IRS awards. Individuals who obtain this elite status must adhere to

ethical standards and complete 72 hours of continuing education courses

every three years.

Qualifications

To become an Enrolled Agent:

.Obtain a Preparer Tax Identification Number (PTIN);

.Apply to take the Special Enrollment Examination (SEE);

.Achieve passing scores on all 3 parts of the SEE

Part

I

,

Part II

,

Part III

.Apply for enrollment using Form 23; and

.Pass a tax compliance check to ensure that you have filed all necessary

tax returns and there are no outstanding tax liabilities. This check is

conducted on your behalf after submission of Form 23.

*Certain IRS employees, by virtue of past

technical experience, are exempt from the exam requirement.

Enrolled

Agent Examination

Three-part exam , consisting of Individual taxation,

businesses and representaion

Continuing Education for Enrolled Agents

An Enrolled Agent must:

•Renew your status as an enrolled agent every three years

•Obtain continuing education

•Renew your PTIN annually

dated November 2, 2023

Tax Preparers Requirements November 2, 2023

In most states, there are no formal educational or credentialing requirements

to work as a tax preparer. California and Oregon, however, regulate tax

preparers who are compensated by their clients. It is important that professionals

within these states research and meet any credentialing requirements so

they may work within the law.

At ATP income tax school we offer tax

preparer classes self study , via correspondence course of classroom

teaching for new preparers entering the profession and established tax

preparers.IRS annual federal tax refresher course in Orlando Florida

is open to all tax preparers . You do not have to work for us.

Mandatory rules for Tax Prepares

Circular 230 establishes certain standards with

respect to tax returns and other submissions to the Internal Revenue Service.

This information is provided courtesy of ATP

Business Solutions Inc an approved IRS continuing education provider for

IRS Annual Federal Tax Refresher Course , Taxpreparer , Continuing

Education Courses|Tax Professional Continuing Education review

classes

FYI

S Corporations in general do not pay corporate

tax , why?

Learn this and more at our tax preparer class at

our tax preparer and enrolled agent income tax school

*

no exam classes

for ce for RTRP and EA at live class

![]()